how much does the uk raise in taxes

In our latest forecast we expect landfill tax to raise 08 billion in 2019-20. Means business across the UK will face a.

Government Revenue Taxes Are The Price We Pay For Government

In 2010 fuel taxes and vehicle excise duties were worth 373 billion pounds 51 billion.

. This represented a net increase of. ONS statistics published in November 2021 reveal the government gained 200 billion in payments to the Exchequer as income taxes PAYE and Self-Assessment and 145 billion in contribution to National Insurance. What is the tax increase for.

The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. There are three main sources of funding. Tax revenue raised by SDIL is expected to reach about 530m per year all of which is aimed at tackling the obesity crisis on school campuses ning its plans for the SDIL in 2016 it estimated that the tax would raise about 530m per year all of which At the end of the current fiscal year just 33m had been claimed by the levy.

How Much Is Customs Tax From Uk To Usa. That would be an extra 91000 in tax revenue per person. 83 of the UK population live in Scotland.

Receipts have recovered their pre-recession share of national income and on current policy are set to rise slightly as a share of national income between now and 201920 and then remain relatively flat until the end of the forecast horizon Figure 1. 9200 tax per head rest of UK. Thus if the UK increased income tax by 1 of national income approximately 20 billion it would still be a long way below the levels seen in Scandinavia.

Create an account for free to get the Reuters unlimited access. We expect 781 per cent of this total to come from UK Government landfill tax with the remaining 167 and 52 per cent coming from the Scottish landfill tax and Welsh landfill disposals tax respectively. In 202021 the value of HMRC tax receipts for the United Kingdom amounted to approximately 556 billion British pounds.

Over 820 billion is raised annually from taxes social security contributions and other sources by the UK government equivalent to around 37 of its GDP based on its estimates. Increases added to the rate applied from 9568-50270 of earnings 12 and to the rate charged on earnings above that 2 It will be extended at that point to cover pensioners who are. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019.

During 201920 the government plans to spend 8 billion. Increasing the point at which people start paying it will cost more than half. Just under 15 percent of adults now smoke.

The table below is a useful guide to how much income tax you actually pay. 10000 tax per head in Scotland. Government Expenditure and Revenue Scotland GERS Or to put it another way.

How Much Does Sugar Tax Raise Uk. Of tax revenue between the UK and Scandinavia is income tax the UK government gets 91 of national income in income tax compared with an average of 160 in Denmark Norway and Sweden. A 201920 financial year of 2 billion corresponding to 1 in revenue was achieved by combining the 201920 tax revenue with 201920 operating revenues.

Government revenue comes from taxes. The government has received 7 billion for this year and 8 billion for next year. Twenty percent of 28000 is 1820 after taxes.

Figure 1 shows that tax as a share of national income has fluctuated between around 30 and 35 of national income since the end of the second world war and been rising since the early 1990s. Taxes as defined in the National Accounts are forecast to raise 6229 billion equivalent to roughly 11800 for every adult in the UK or 9600 per person. The dividend ordinary rate will be set at 875.

How Much Income Tax do People Pay. Chancellor Rishi Sunak has presented two Budgets already and faces introducing UK tax rises to pay for unprecedented levels of public spending. Income tax National Insurance contributions NICs and value added tax VAT.

The United Kingdom has 9 million people. This measure increases the rates of Income Tax applicable to dividend income by 125. Council tax increase 2022.

The UK tax. The UK raised 35 of national income in tax in 201819. The original 125 percentage point increase in NI was supposed to raise 12bn a year.

An expected 8 million will be raised from tobacco tax in 202021. Those on higher incomes pay bigger of tax. How Much Tax Is Raised From Fuel Uk.

How much the rate is rising and when the 150 council tax rebate will be paid. How much does the UK raise in tax compared to other countries. There is a 28000 tax on these goods since they are not shipped.

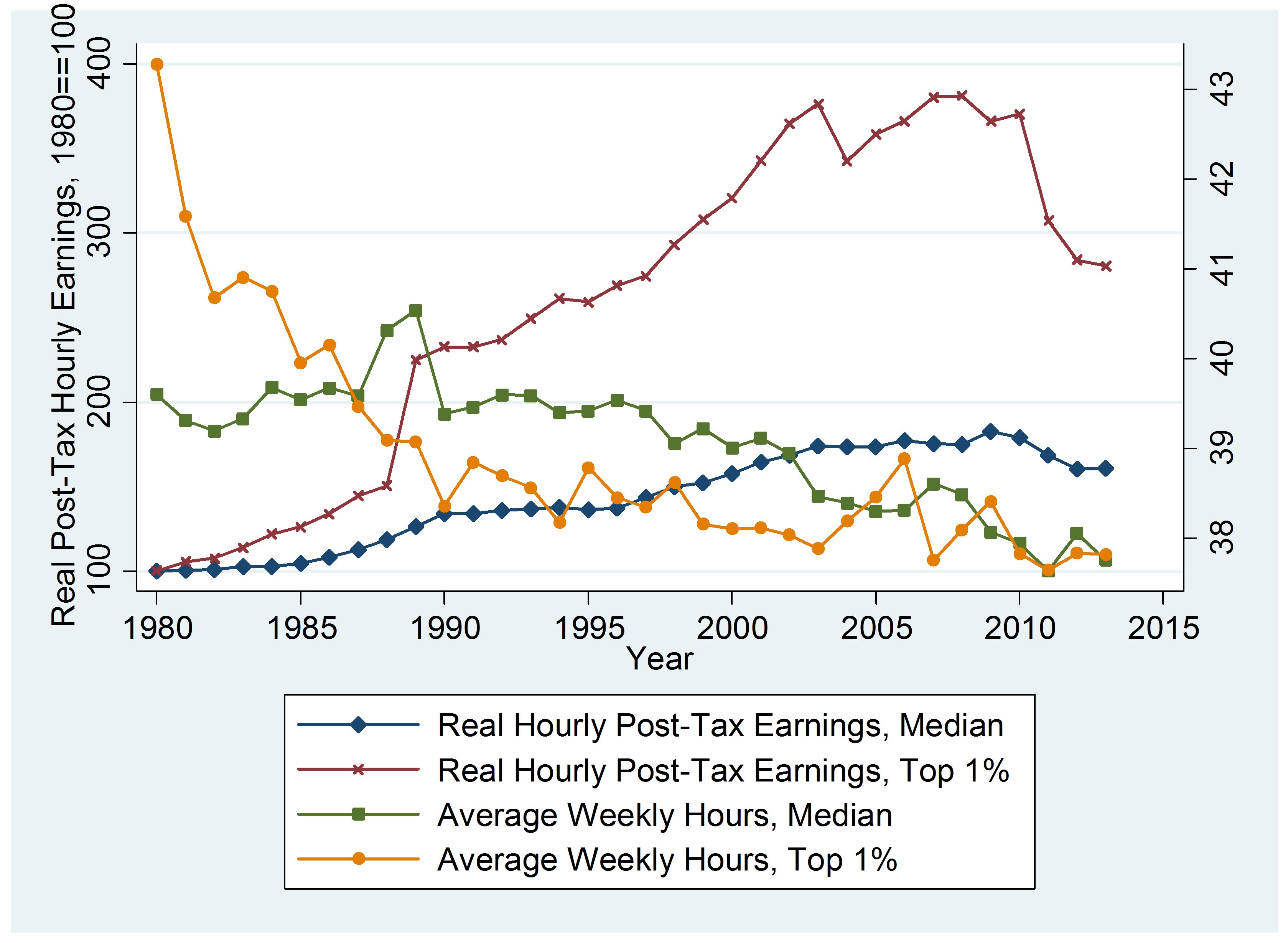

Changes in tax revenue 1997 2014. By the end of 202021 the taxes would amount to more than 40 of total revenue of 792 billion. It shows that income tax in the UK is progressive.

UK Income tax is based on marginal tax rates. Johnson had promised to. UK tax revenues were equivalent to 33 of GDP in 2019.

Total tax receipts in 201718 are forecast to be 690 billion.

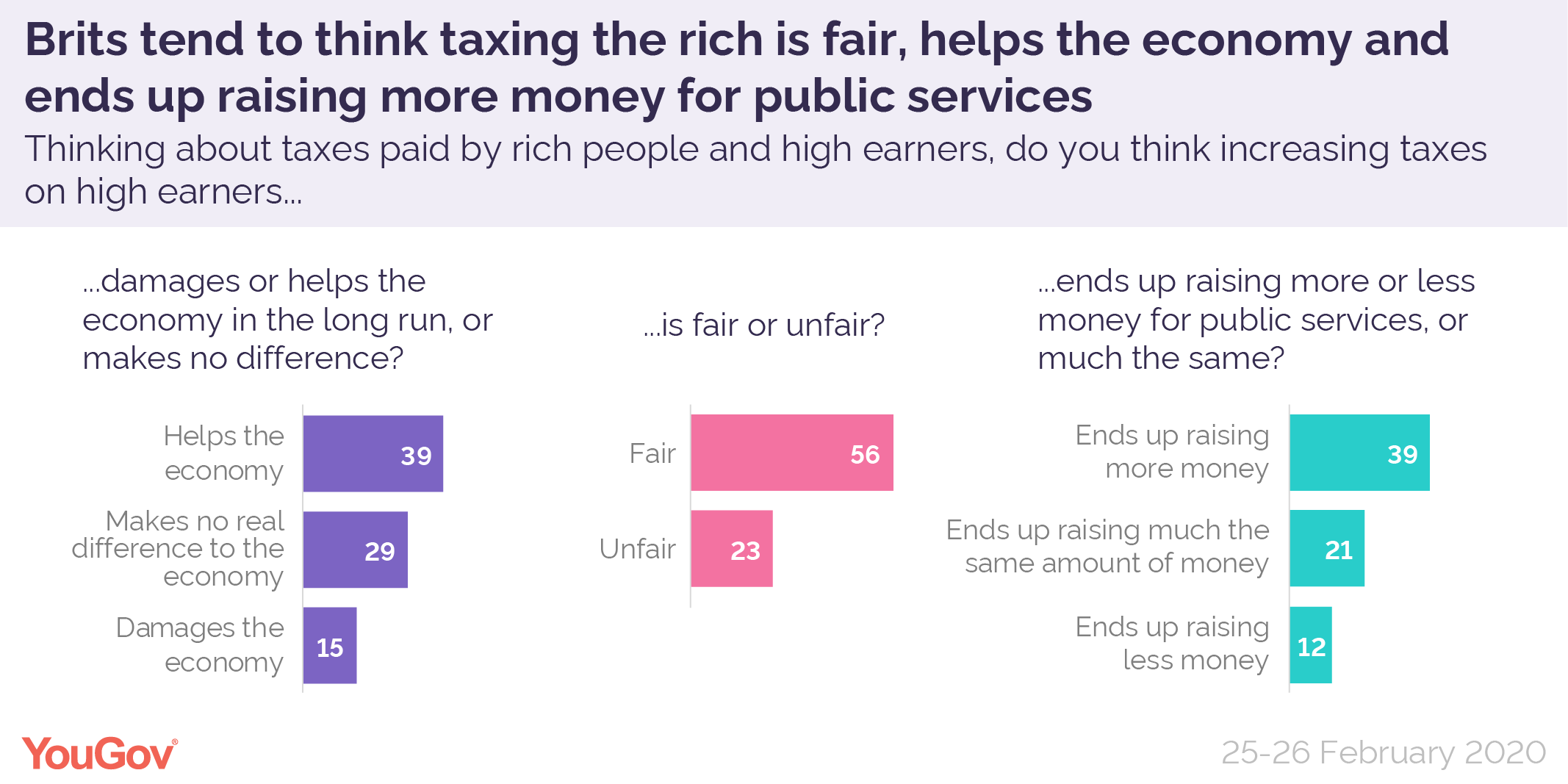

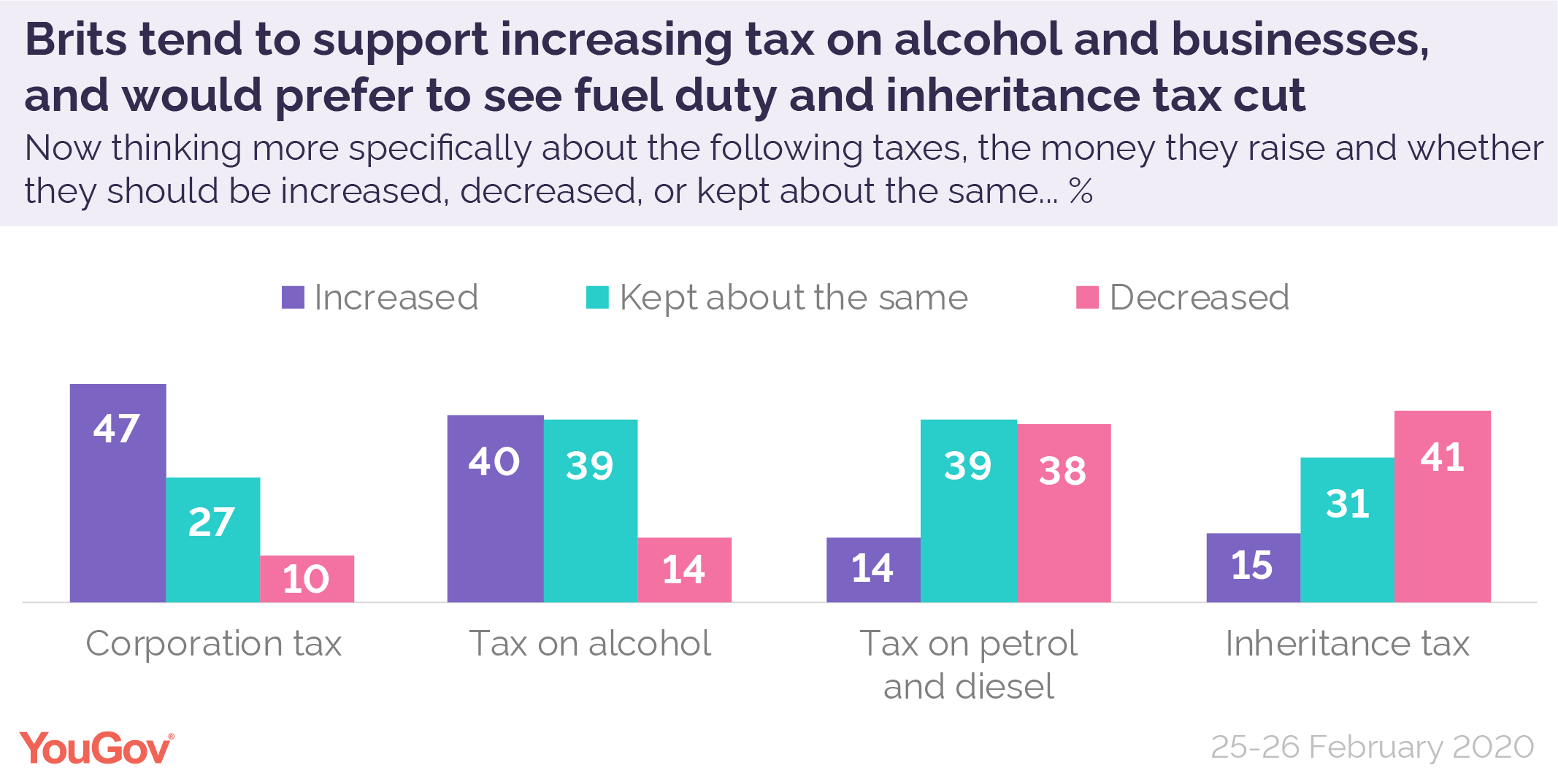

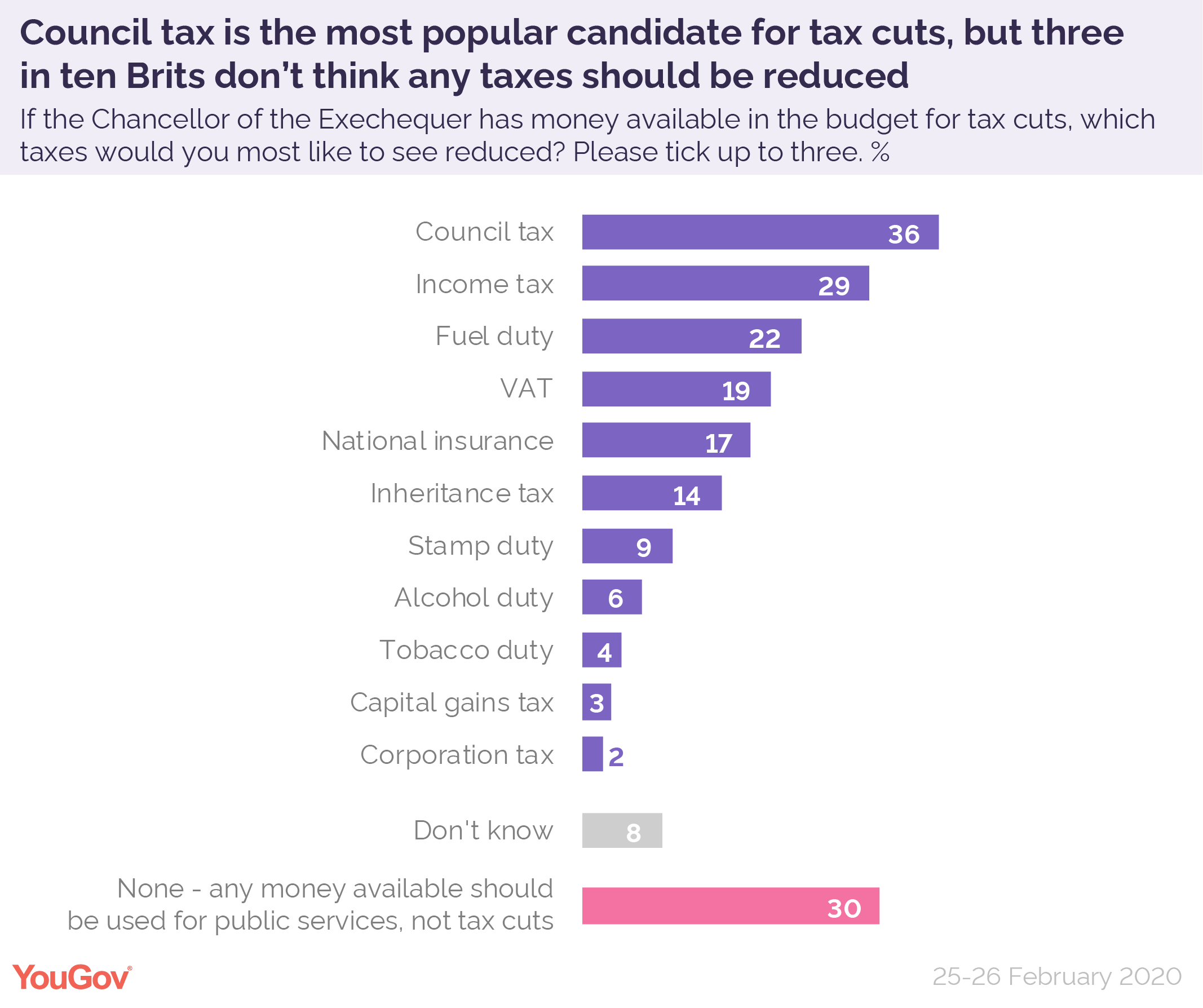

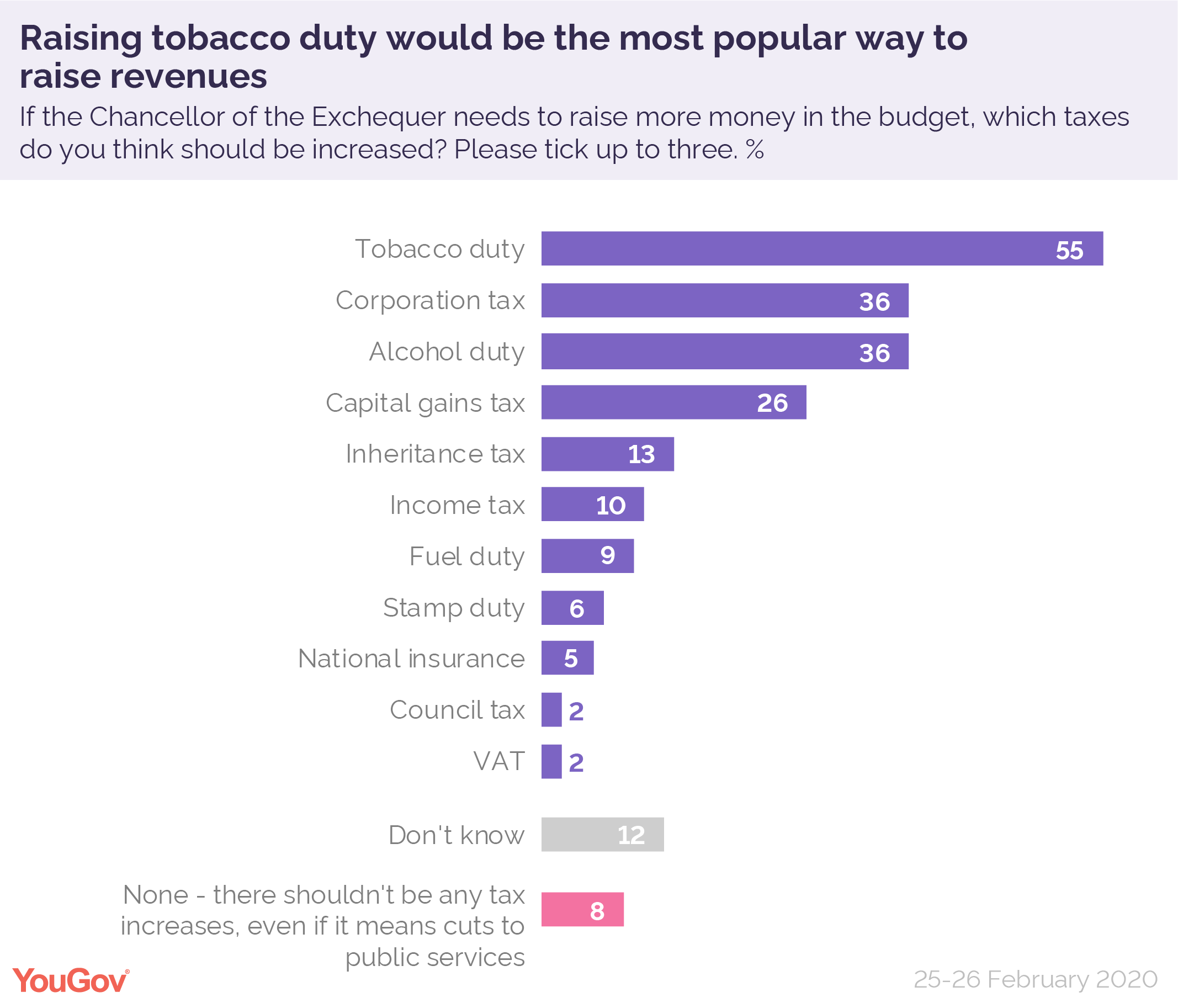

Budget 2020 What Tax Changes Would Be Popular Yougov

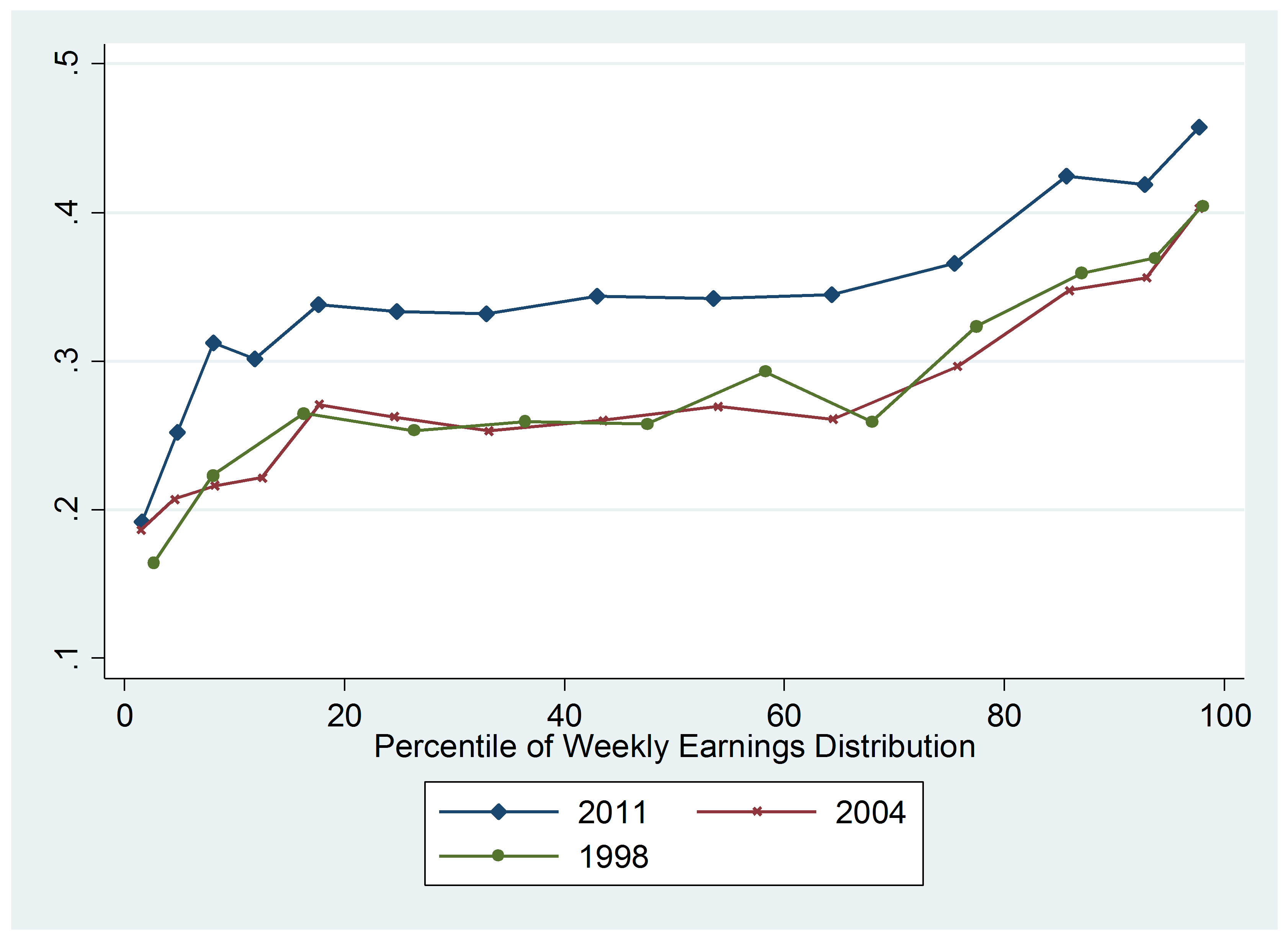

The Top Rate Of Income Tax British Politics And Policy At Lse

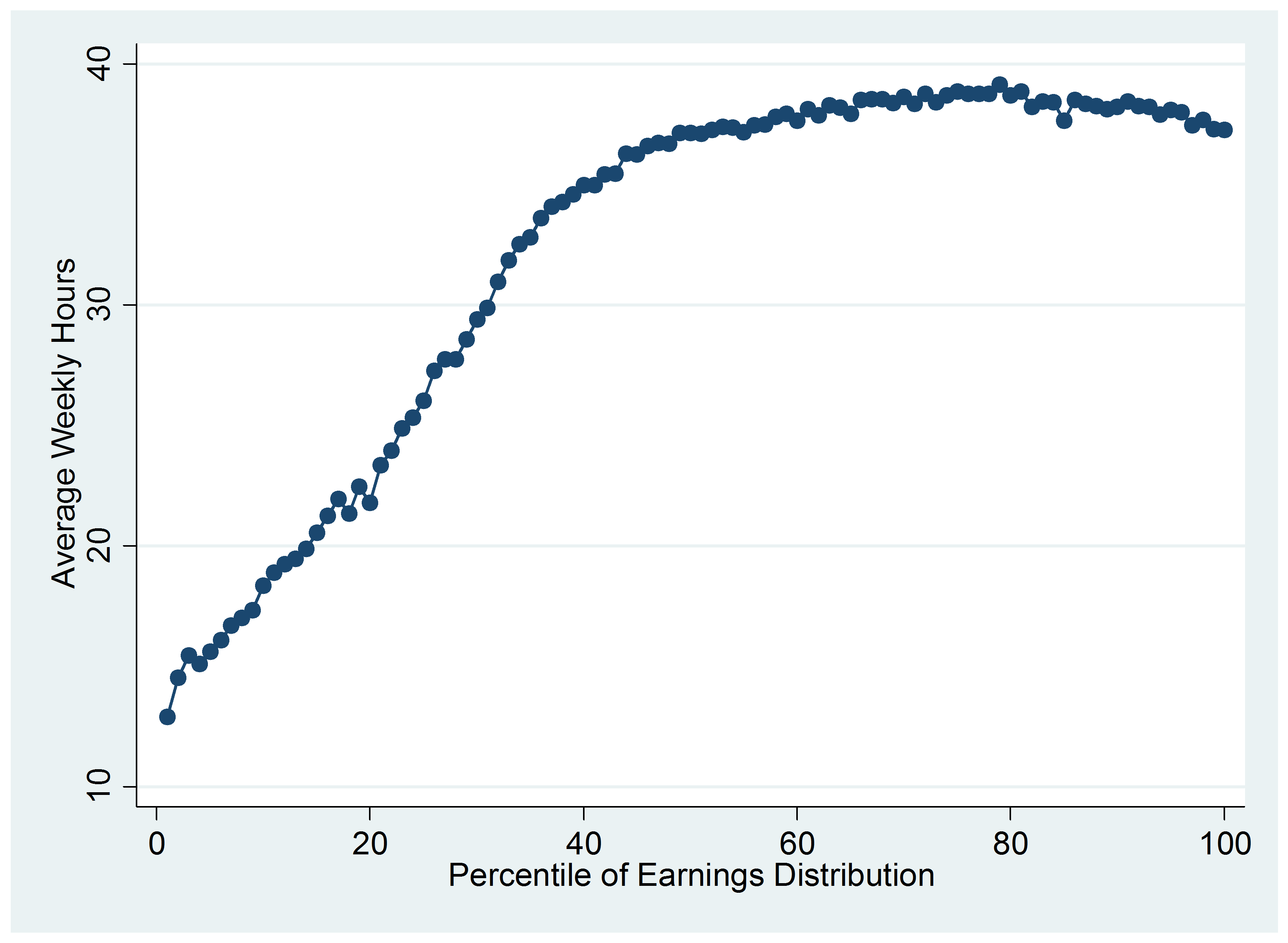

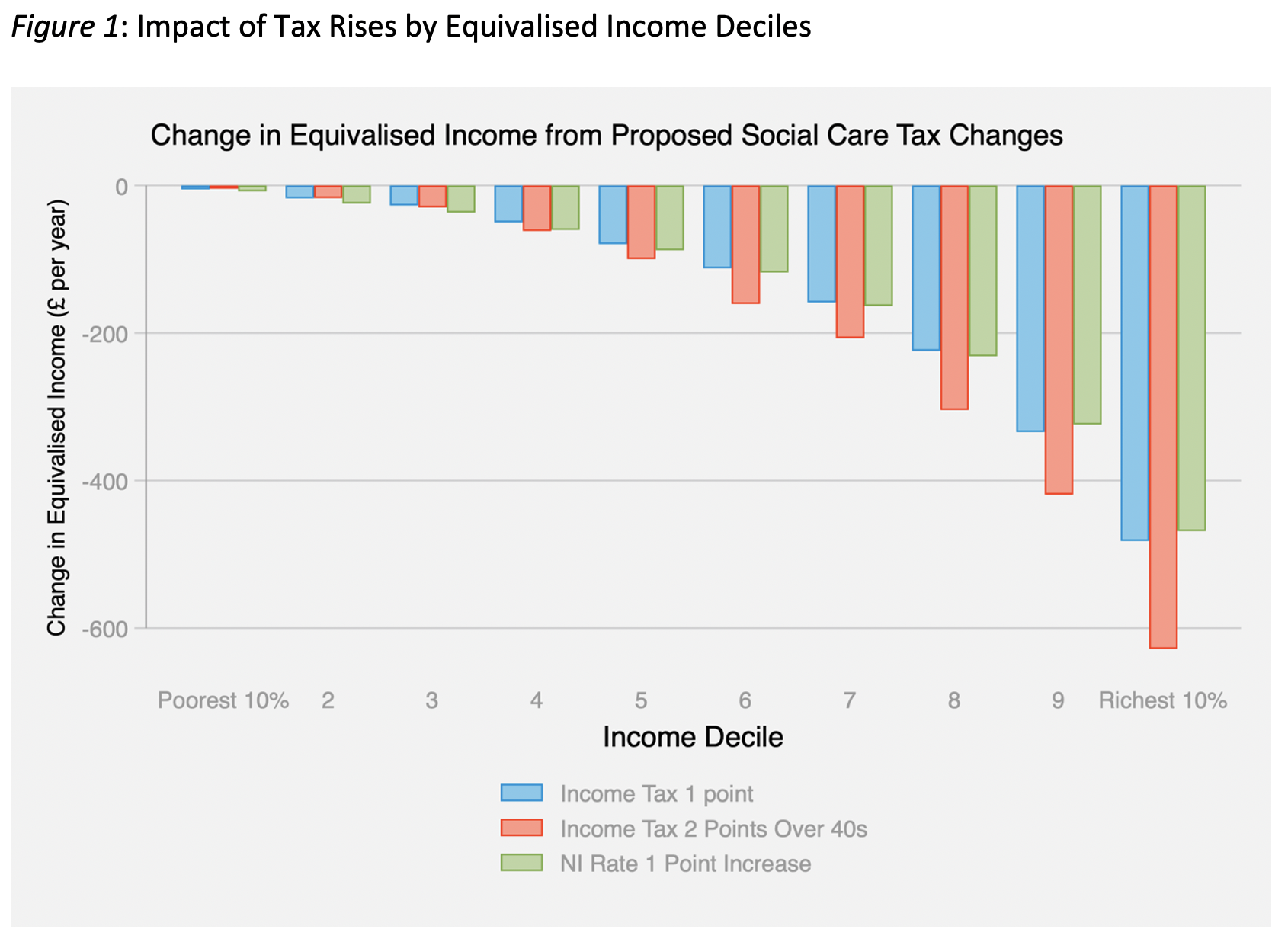

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

The Top Rate Of Income Tax British Politics And Policy At Lse

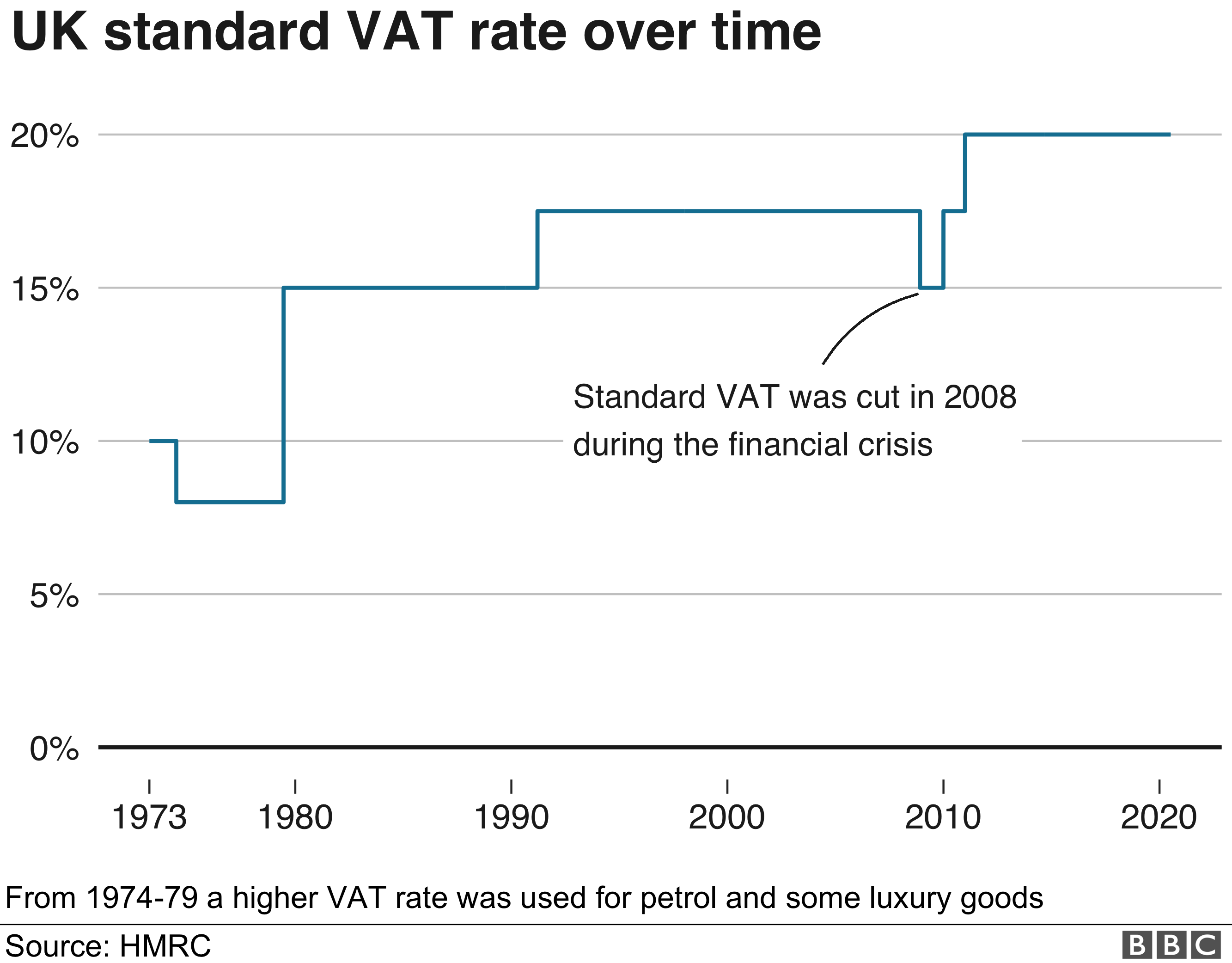

What Is Vat And How Does It Work Bbc News

Types Of Tax In Uk Economics Help

Uk Spring Statement Updates From March 23 Sunak Cuts Fuel Duty And Promises Lower Income Tax Financial Times

The Top Rate Of Income Tax British Politics And Policy At Lse

Tax After Coronavirus Treasury Committee House Of Commons

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

Budget 2020 What Tax Changes Would Be Popular Yougov

How Do Taxes Affect Income Inequality Tax Policy Center

Government Revenue Taxes Are The Price We Pay For Government

Budget 2020 What Tax Changes Would Be Popular Yougov

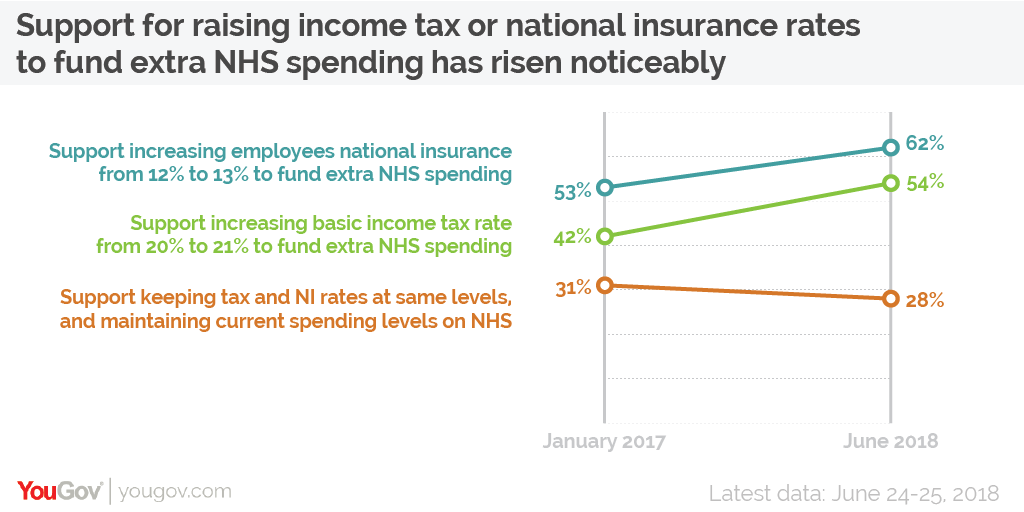

A Majority Of Brits Now Support Increasing Income Tax To Fund The Nhs Yougov

Budget 2020 What Tax Changes Would Be Popular Yougov

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For