pa inheritance tax exemption

If you or your spouse have a disability that is 100 service-connected you may qualify for a Real Estate Tax exemption. As it shows the exemptions range from 1 million in Massachusetts and Oregon to 585 million in New York.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Pennsylvania Inheritance Tax Safe Deposit Boxes.

. Client Review I worked for Peter Klenk for 4 wonderful years. REV-485 -- Safe Deposit Box Inventory. The tax credit applies for the period of time you were called to active duty outside of Pennsylvania.

The another change under the 2000 tax act has to do with an exemption from tax that applies to assets that pass from a child to a. The Pennsylvania tax applies regardless of the size of the estate. Reported on a Pennsylvania Inheritance Tax Return REV 1500 filed within 9 months of the decedents date of death or within 15 months of the decedents date of death if the estate or person required to file the return was granted the six-month statutory extension.

Connecticuts 51 million exemption for 2020 puts it 9th among the 13 jurisdictions. REV-714 -- Register of Wills Monthly Report. If there is no spouse or if the spouse has forfeited hisher rights then any child of the decedent who is a member of the same household as the decedent may claim the exemption.

How do I close my Revenue Accounts Sales UseTax Employer Withholding Public Transportation Assistance Fund Taxes Vehicle Rental Tax and Tobacco Taxes. Free Consultations 215-790-1095 Δ. What is the difference between the Property Tax and Rent Rebate ProgramProperty taxes paid by an owner on their home.

In United States tax law there is a distinction between an estate tax and an inheritance tax. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. Disabled Veterans Real Estate Tax Exemption.

Inheritance tax is a tax imposed on those who inherit assets from an estate. It is different from the other taxes which you might pay regularly. REV-571 -- Schedule C-SB - Qualified Family-Owned Business Exemption.

There is still a federal estate tax. New Inheritance Tax Exemption for Military Deaths. Pennsylvania Inheritance Tax and Gift Tax.

5 Greentree Centre 525 Route 73 North. The federal estate tax exemption is 1170 million in 2021 and 1206 million in 2022. Client Review I worked for Peter Klenk for 4 wonderful years.

REV-229 -- PA Estate Tax General Information. This article explains in depth how the inheritance tax may affect you. REV-346 -- Estate Information Sheet.

The Pennsylvania Inheritance Tax is a Transfer Tax. Who qualifies for the family-owned business exemption from inheritance tax. File and pay inheritance taxes.

The same however cannot be said of Pennsylvania inheritance tax. In personal income tax further providing for classes of income and repealing provisions relating to COVID-19 emergency finance and tax provision. Assets of Dissolving Fire Company Distributed to Other Fire Companies.

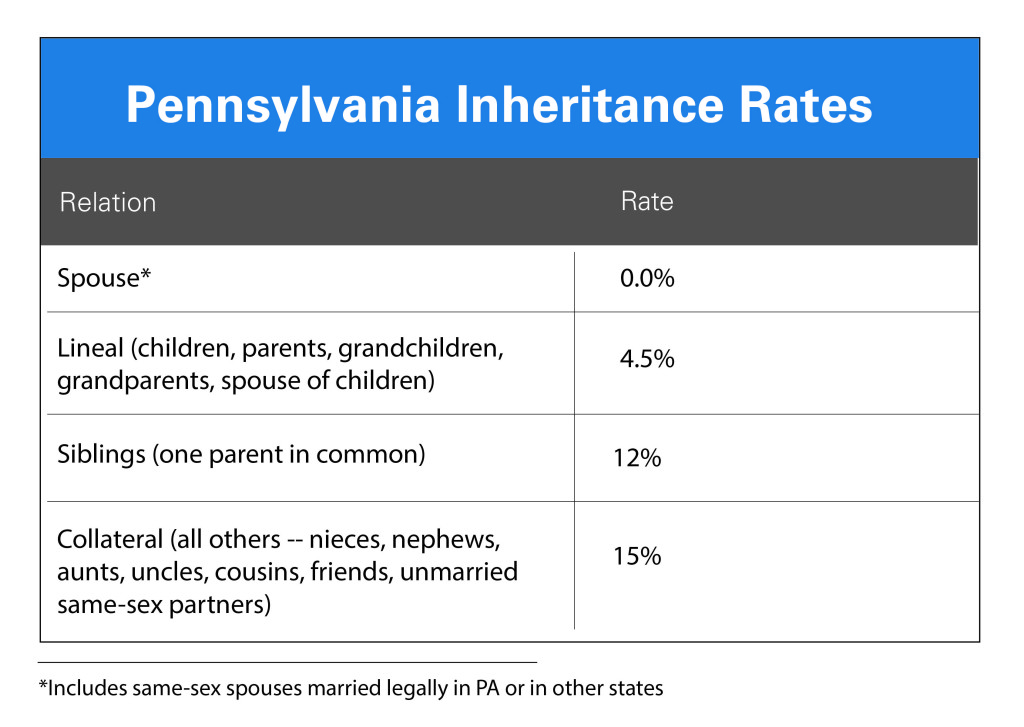

Though there is no estate tax there is an inheritance tax in Pennsylvania. An Act amending the act of March 4 1971 PL6 No2 known as the Tax Reform Code of 1971 in sales and use tax further providing for definitions for exclusions from tax and for licenses. Inheritance tax estate tax and death tax or duty are the names given to various taxes that arise on the death of an individual.

I cant speak highly enough of everyone at the firm. The percentage paid depends on the relationship between the heir and the decedent. The former taxes the personal representatives of the deceased while the latter taxes the beneficiaries of the estate.

5 Greentree Centre 525 Route 73 North. Get a real estate tax adjustment after a catastrophic loss. No Undue Influence by Spouse.

Get a marriage license. King of Prussia PA. Table 3 shows for each of these jurisdictions the estate tax exemption amounts ie taxable estate thresholds and top statutory rates for 2020.

There are however ways to reduce Pennsylvanias inheritance tax. In corporate net income tax further. How do I know if I qualify for the Property TaxRent Rebate.

A widows exemption is one of several forms of state or federal tax relief available to a widowed spouse in the. Get a copy of a divorce decree. Get a nonprofit real estate tax exemption.

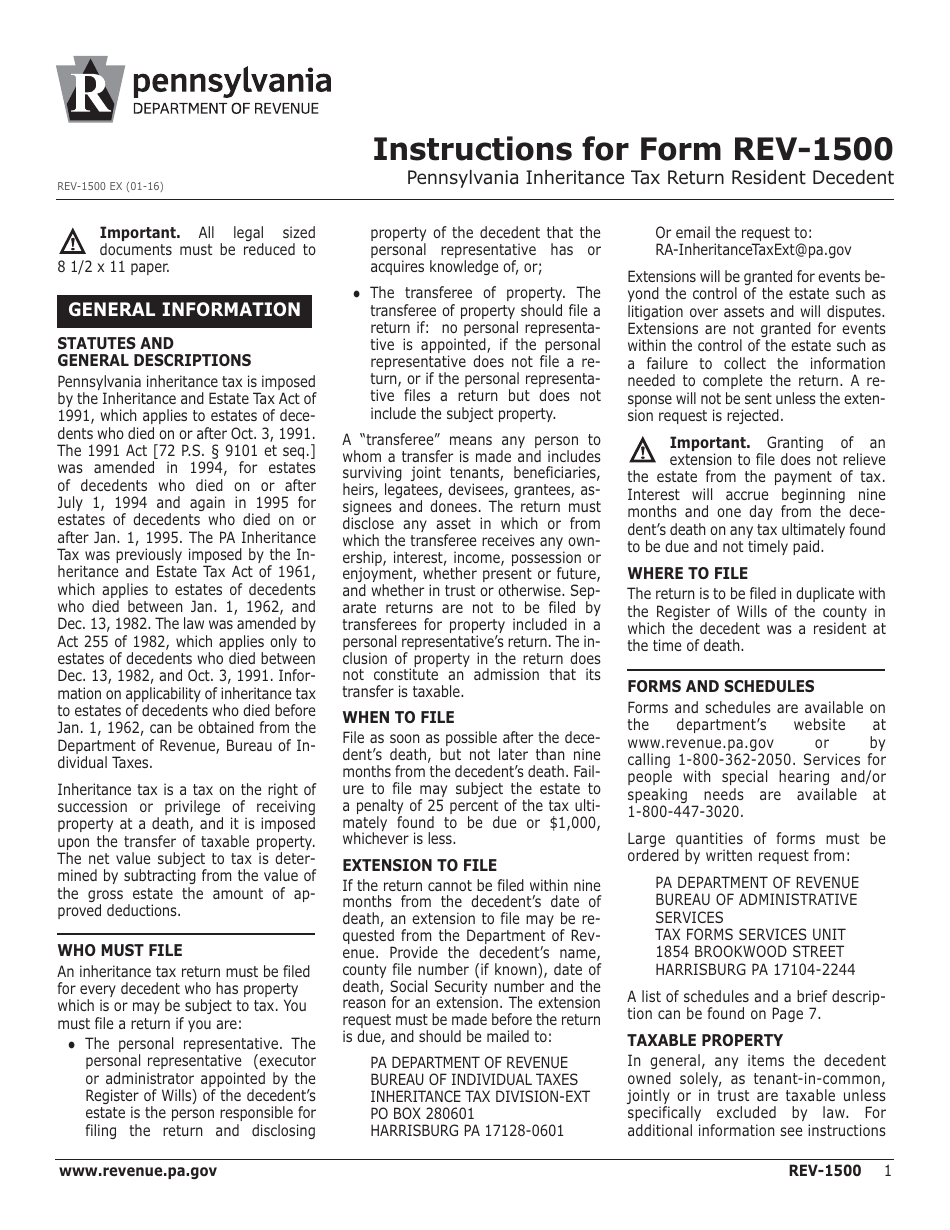

Download Instructions For Form Rev 1500 Pennsylvania Inheritance Tax Return Resident Decedent Pdf Templateroller

Pennsylvania Estate Tax Everything You Need To Know Smartasset

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

Inheritance Tax 2022 Casaplorer

Form Rev 1500 Download Fillable Pdf Or Fill Online Inheritance Tax Return Resident Decedent Pennsylvania Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New York S Death Tax The Case For Killing It Empire Center For Public Policy

The Pennsylvania Inheritance Tax Plan For It

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Pennsylvania Inheritance Tax 39 Free Templates In Pdf Word Excel Download

Pennsylvania Inheritance Tax 39 Free Templates In Pdf Word Excel Download

Pennsylvania Inheritance Tax Acorn Law Telford Pa

Download Instructions For Form Rev 1500 Pennsylvania Inheritance Tax Return Resident Decedent Pdf Templateroller

Estate Gift Tax Considerations

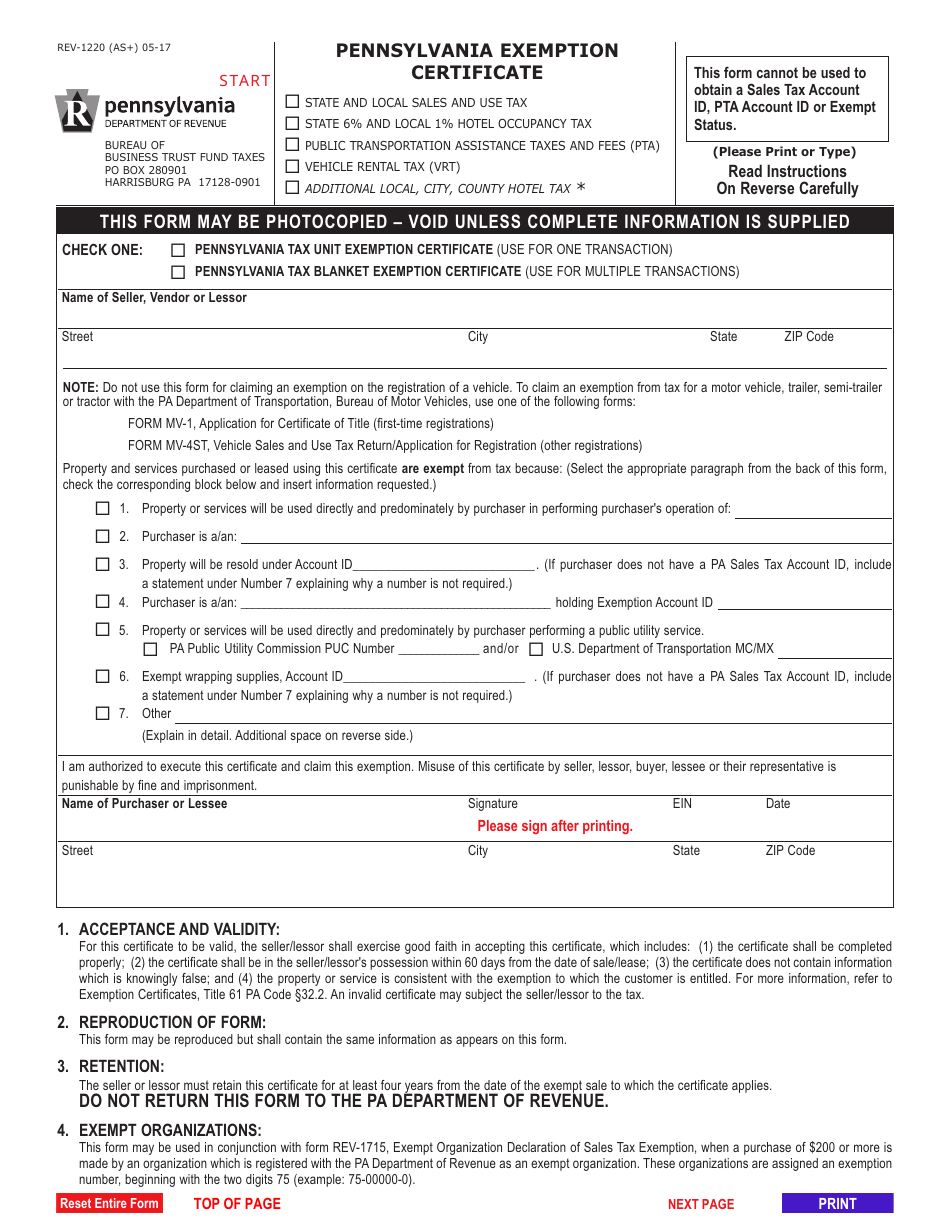

Form Rev 1220 As Download Fillable Pdf Or Fill Online Pennsylvania Exemption Certificate Pennsylvania Templateroller